According to U.S. Department of Health and Human Services, there is over a 70% chance that people aged 65 and up will need some form of long term care services. Here’s what you can expect for long term care costs.

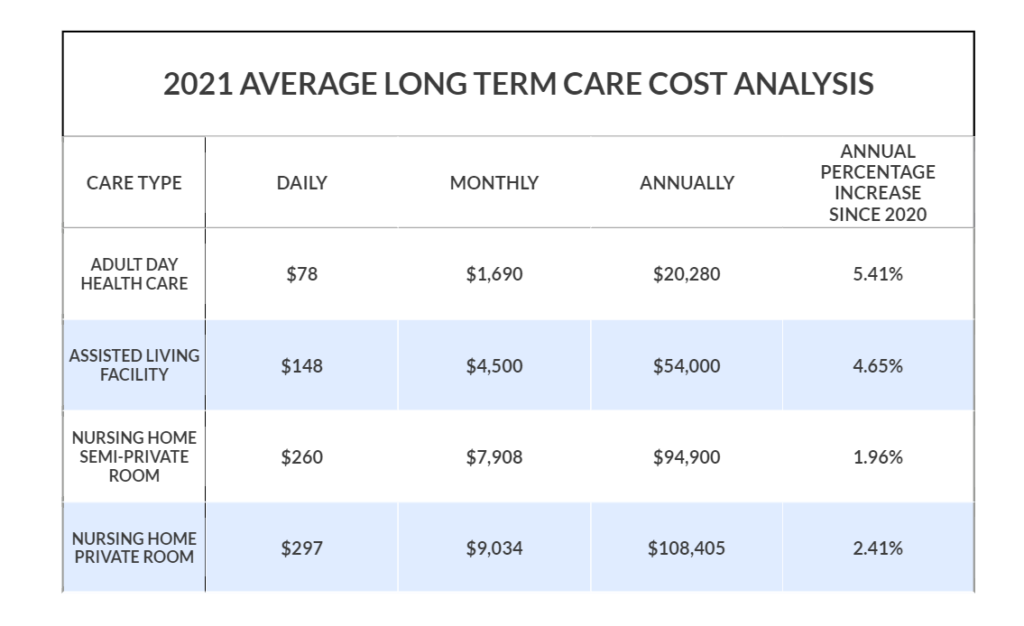

Average facility care cost

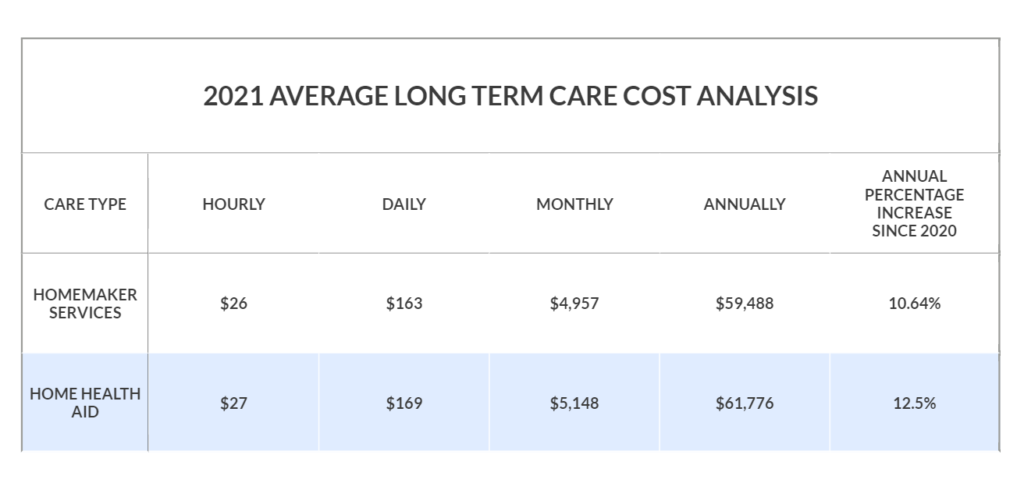

Average Home Care cost

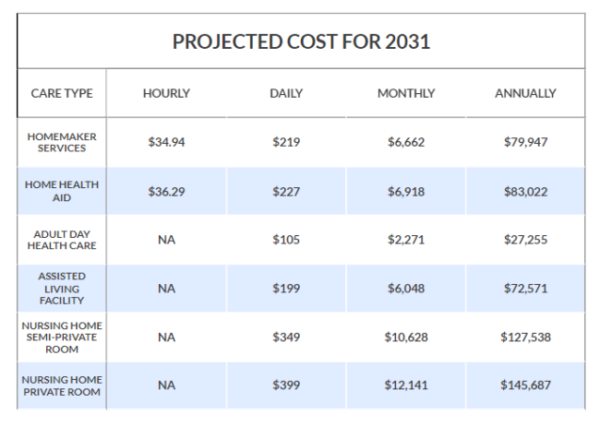

Keeping these current average costs in mind, here’s what it might look like 10 years from now with a projected average annual increase of 3% .

2031 Care Cost projection

Looking at the projected long term care costs for 2031 with an annual 3% compounding inflation, and taking into account the average length of care needs for men (2.5 years) and women (3 years) you could be looking at nearly $500,000 per person in costs. This does not take into account your current geographical location. Can your family handle these costs if you can’t? What happens if you have enough to cover only one spouse but not the other? Even if you have enough to cover both partners in a marriage by spending down your assets, there are funeral costs to think about after you both die. How will your family cover those costs if there is nothing left over to your heirs when you pass? Do you want to burden your family with these costs if it comes to that?

With a hybrid LTCI policy, you can cover long term care costs for both yourself and your spouse along with leaving behind a minimal death benefit for your loved ones to use towards funeral expenses.